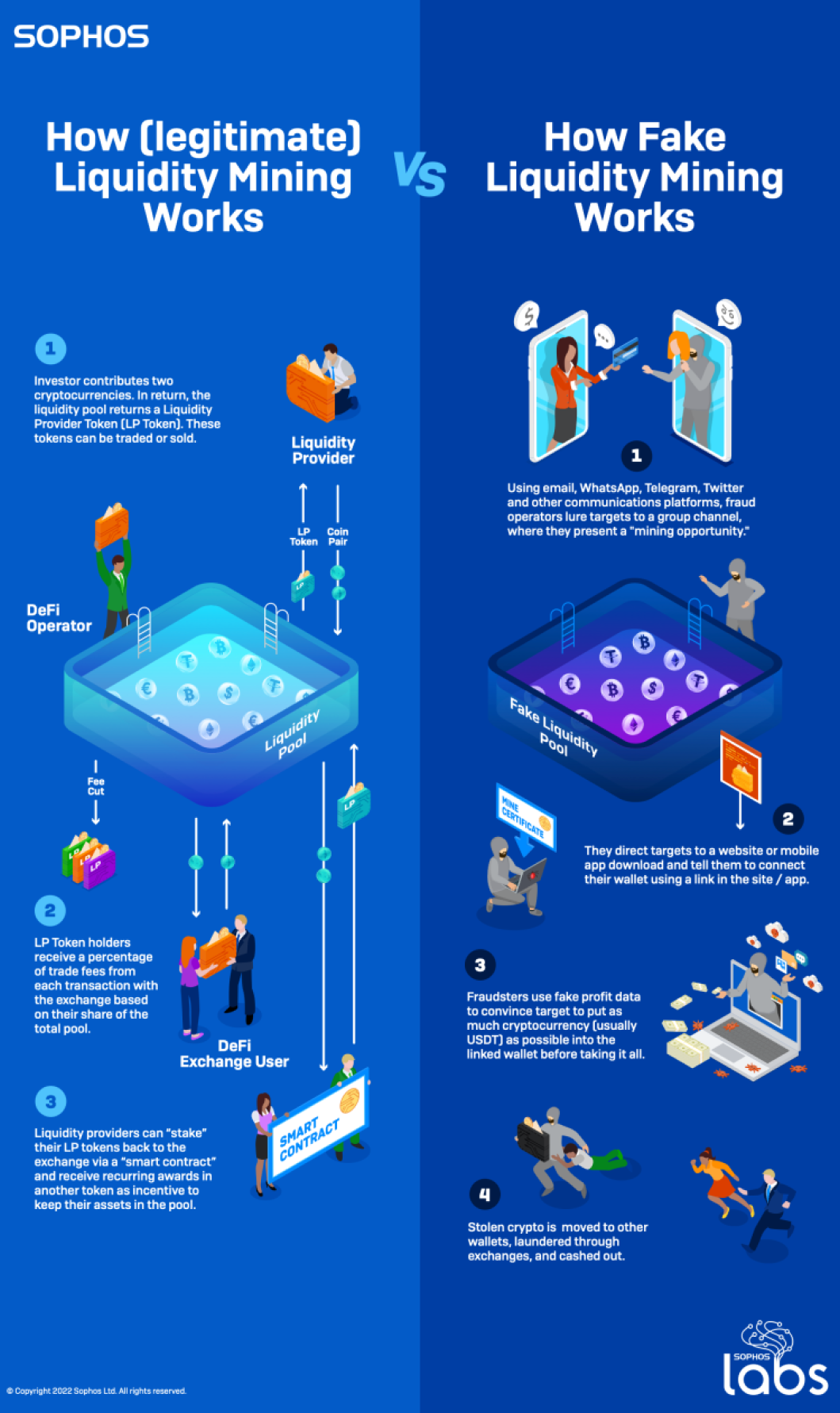

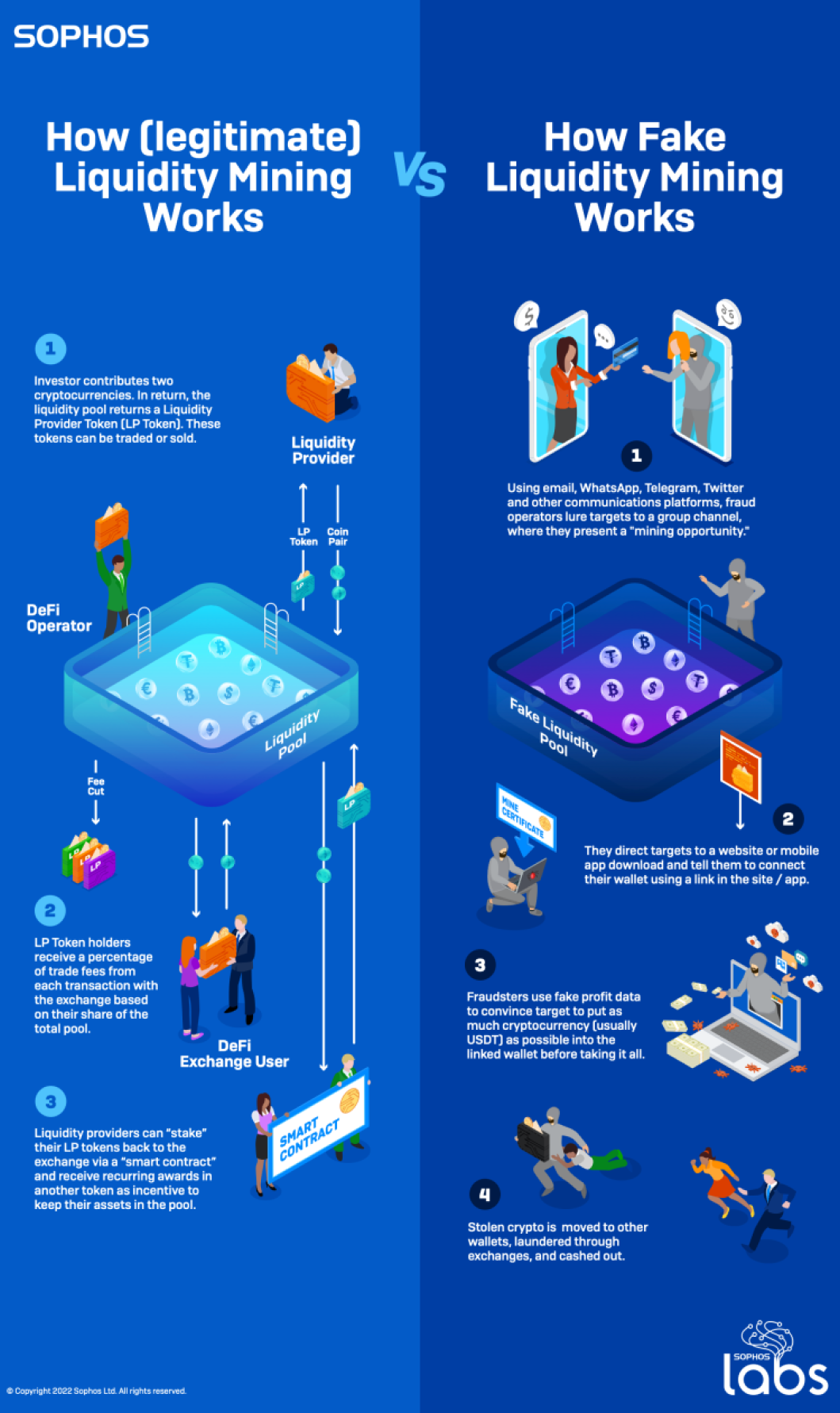

Legitimate liquidity mining exists to make it possible for decentralized finance (DeFi) networks to automatically process digital currency trades. DeFi is an emerging financial technology that uses a blockchain-based distributed ledger similar to that used by cryptocurrencies to adjudicate trades between different types of crypto—governed by trading protocols built into the ledger itself.

Centralized cryptocurrency exchanges act as “market makers” for trades out of their deposits. Coinbase and other exchanges often reward larger investors (with reduced trading fees and other benefits) for allowing portions of their deposits to be used to guarantee the exchange has enough of popularly-traded pairs of cryptocurrency to assure trades can be handled. For example, if someone wants to cash out of Ethereum and exchange it for a “stablecoin” such as Tether (USDT), the exchange needs to have enough USDT available in reserves to make that trade and fulfill the transaction. The same is true in the other direction.

DeFi exchanges do trades differently—they’re executed by a protocol built into their networks known as Automated Market Makers (AMMs). Smart contracts built into the DeFi network have to rapidly determine the relative value of the currencies being exchanged and execute the trade. Since there is no centralized pool of crypto for these distributed exchanges to pull from to complete trades, they rely on crowdsourcing to provide the pool of cryptocurrency capital required to complete a trade—a liquidity pool.

To create the liquidity pool—which usually handles transactions between a single pair of cryptocurrencies—investors commit equal values of both cryptocurrencies to the pool, tying them on the blockchain to the smart contract. In exchange for lending that crypto to the pool, the contributors get a reward based on a percentage of the trading fees associated with the DeFi protocol. The “mining” part comes from liquidity pool tokens (LP tokens)—a representation of the share of the liquidity pool contributed by the investor.

The LP tokens themselves are in essence another cryptocurrency, pegged to the value of the percentage of the pool they’re associated with.

Holding the tokens usually comes with benefits: a percentage of trading fees, and other rewards. There is also risk of loss—for example, the value of the pool of crypto may fall, and therefore the cashout value of the tokens could drop below the initial buy-in cost. But as long as the people behind the tokens don’t take the assets in the pool and run, there is at least a way for investors to get off the merry-go-round.

Unfortunately, there are several ways things can go awry if the people behind the liquidity pool are unethical—or flat-out criminal. There is no regulation of DeFi exchanges, and the only thing guaranteeing they’re on the up-and-up is the smart contract code built into the DeFi network’s (usually Ethereum-based) blockchain. But if the tokens get cancelled—or there was never really a pool backing them at all—that all goes out the window. There is ample opportunity for digital Ponzi schemes, fraudulent tokens, and flat-out theft.

Unfortunately for the crypto-curious, there are plenty of unethical and criminal “liquidity mining” schemes out there. Like the CryptoRom rings we’ve tracked, they use a variety of social media and messaging tools to approach potential victims (as well as spam emails). In some cases, they also use fake mobile applications and websites that emulate or fake connections to better-known organizations in blockchain-based trading.